I just referred my wife to this card as this is not a current public offer.

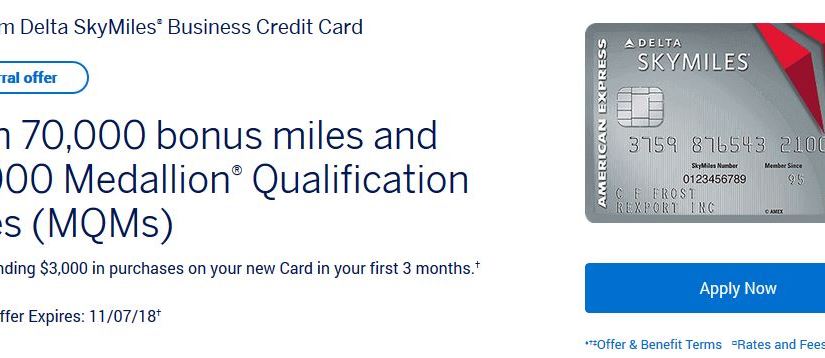

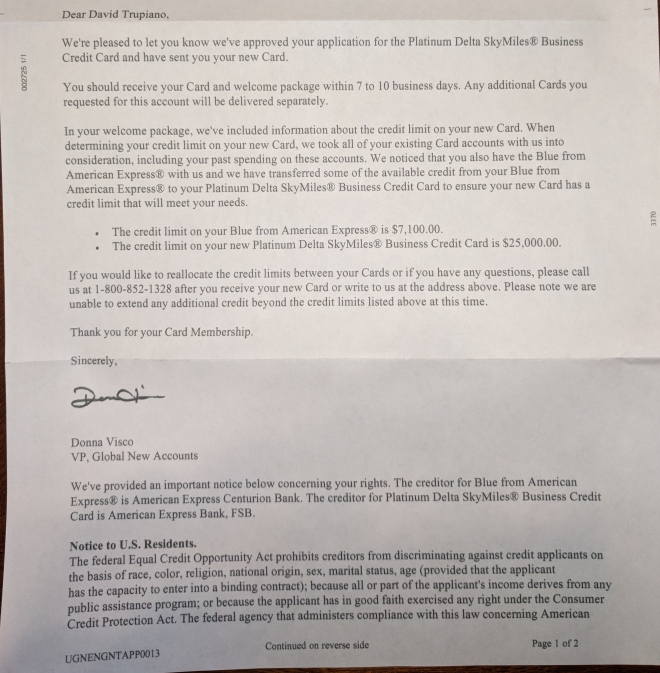

In March of 2018, I applied and was approved for Delta Business Platinum American Express card. The offer was 70k points, plus $100 credit on Delta in the first 3 months, for a $195 annual fee. Just recently there was the same public offer, but that expired a few weeks ago. However I have a referral for the same 70k points after meeting $3k spend in the first 3 months (no $100 credit though). Plus I get 10k bonus points. So if course I referred my wife. There are a whole bunch of benefits with this card like 10k MQMs, companion certificate, and free checked bags. Of course the 70k points is what draws people in though.

The application took a whole 2 minutes and my wife was put in pending stage with a request to call AMEX to verify business information. We have had a small personal business we pay taxes on since 2010. My wife hates having to call in to verify information though. The next day I wrote down some of the general company information like revenue, income, why she needs another card, etc. Then we made the call to AMEX. After confirming her identity, she was instantly approved without having to talk to a live person! We have both have had several business cards in the past few years, and it seems like AMEX just wants to quickly verify your information and phone number to approve.(I have had to call AMEX on my business cards as well in the past)

Think you don’t have a business- well have you sold something on eBay this year? or held a garage sale? You don’t need millions of dollars in revenue to have a business. You don’t need a Tax ID number either, just your social security number is fine.

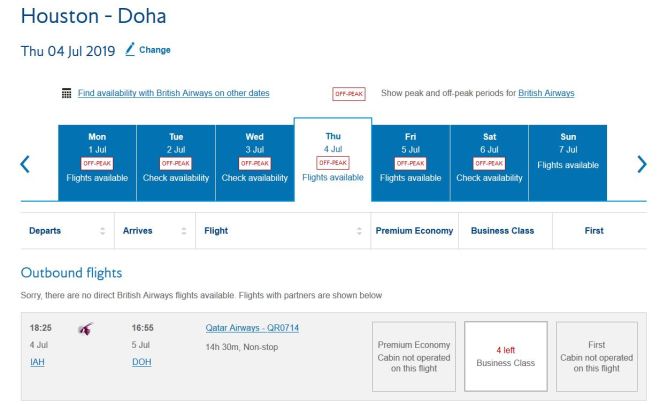

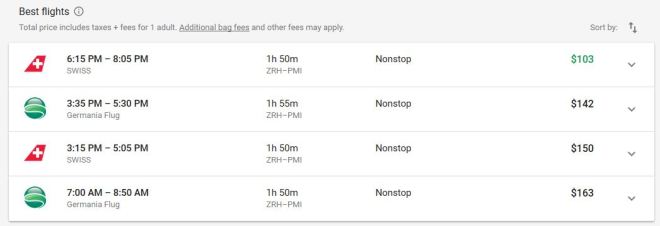

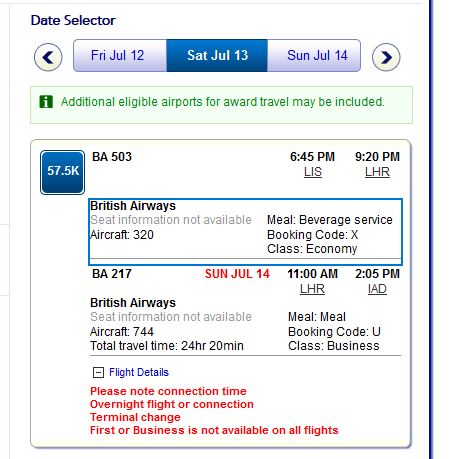

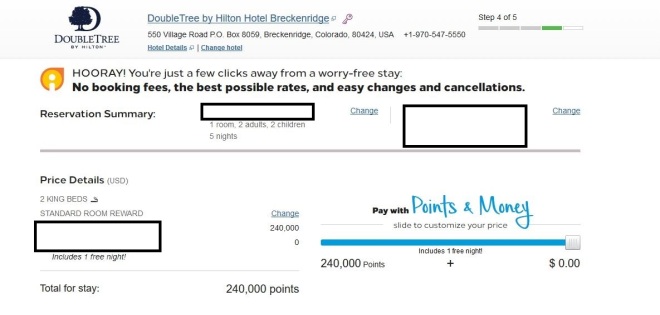

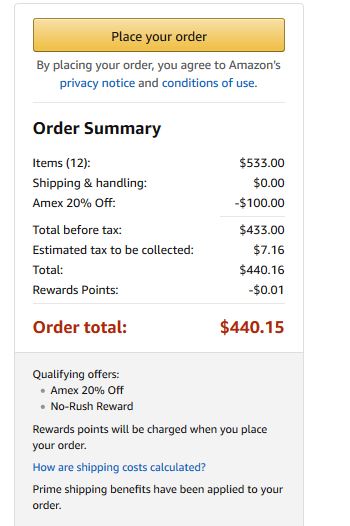

After using the card we will easily have 75k Delta miles. These miles can be used for 3 round trip economy tickets in the US, or a one way business class ticket to London, Paris or other destinations in Europe.

In 2016, our family took our vacation together using Delta Miles to fly on Virgin Atlantic’s Upper Class to London. Our kids have been spoiled since then.

If you are interested in this non-public offer, here is the link!

http://refer.amex.us/DAVIDT2yiK?xl=cpce

You must be logged in to post a comment.